Home Seller Net Proceeds Calculator: Calculate Your Net Closing Costs on Real Estate Sales

Table of Content

Meanwhile, 37 percent find staged homes more appealing when it’s decorated to their taste. When it comes to home-selling, not everyone stages their property. Some people put their house on sale without highlighting its best features. So if they made $400,000 in taxable income they would pay 15% of $30,000, or $4,500 in longterm capital gains on the home sale. In the case when the seller sells their current house but the sale of their new house has not closed yet, they may not be able to move in. This means that they will have to pay for furniture storage until the sale closes and they can officially move in.

Closing costs vary depending on your real estate market, final sales price, commission rates, and other factors. When a house sells for over $100 via a real property sale, the seller must record the transfer with the county where the house is. South Carolina home sellers pay both their listing agent’s fees and the buyer’s agent commission. The average rate for a listing realtor in South Carolina is 2.82%, while a buyer’s agent averages nearly the same rate at 2.81%. So, that would be a $16,642 deduction from a $295,598 sale . There are different sets of fees included in the seller’s closing costs.

How much do you pay in taxes when you sell a house in North Carolina?

Settlement companies typically charge a base fee, plus a small percentage of the sale price. For example, an escrow company may charge a $1,000 base fee, plus 0.2% of the sale value of the property. North Carolina sellers throughout the state pay a 0.2% transfer tax, plus an additional 1% land transfer tax in seven counties. They’re also responsible for property taxes, but only for the total number of days they owned the home during the sales year. Most Texas home sellers should expect to pay closing costs of between 7.7–8.7%, including realtor fees.

North Carolina charges $1.00 per $500 of the property value (0.2%) in transfer taxes when homeowners sell their houses. Buyers often pay more in closing costs since they usually need a mortgage to purchase the home, and lender fees increase the buyers' settlement costs. Some buyers can lower closing costs with lender assistance. You may also lower your total expenditure by negotiating closing costs with the people who want to buy your home. For example, some motivated buyers are willing to pay closing expenses traditionally assigned to the seller. In markets that favor buyers, you might offer your buyer a credit toward closing costs during negotiations.

Homeowners association fees

At the end of the day, you want to make the house look warm and inviting. A great home impression gives you better chances of selling at a higher price. Your goal is to stage the home to appeal to the widest number of buyers.

It is not Zillow's intention to solicit or interfere with any established agency relationship you may have with a real estate professional. All costs are estimates and no guarantee is made that all possible costs have been included. Government recording fees are charged by the local government for making a public record of the sale. The fee varies depending on location, but will probably be less than $200. Before you jump in, you’ll want to know what kinds of expenses you may face when selling a home without an agent. Rather than viewing concessions as an extra expense, think of them as bargaining chips to negotiate a higher selling price with the buyer.

Example Longterm Capital Gain Calculation On Selling Primary Residence

While the property tax rate can vary widely state to state, all 50 states have some form of property taxes. So, the 4-6% in commission makes up a large portion of your closing costs in any sale. A municipal lien search looks for code violations, water and sewer unpaid balances and open or expired permits.

The average cost of painting a room ranges from $350 to $850. If the house is due for a paint job, painting helps sell your home at a way better price. Sellers usually have mixed feelings about staging their home. At the same time, you think your home is beautiful and can sell “as is.” But more often, people don’t share your taste when it comes to selecting interiors. Potential buyers have reservations with pets in the house. You also need to deal with pet odors, which can be neutralized by washing stained areas and using air fresheners.

Mortgage Rates & Loans

Connect with top-rated agents near you and save thousands on commission fees. The cost of escrow — around 1% of the purchase price — is typically split evenly between the buyer and seller. In some areas, it's customary for the seller to pay for the owner's policy. Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. Closing costs are typically about 3-5% of your loan amount and are usually paid at closing.

In some states, you’re actually required by state law to have a real estate attorney present when a home is bought or sold. If you do hire a lawyer, he or she will often be paid at closing, out of the proceeds from the sale. If you’re living in a community that is subject to a homeowner’s association , you likely pay monthly, quarterly, or yearly dues. Just like with property taxes, you’ll have to make sure you’ve paid up to the close date, which can mean forking out some cash at closing.

The Canadian home inspection will catch any hidden problems in the home that could have future consequences or be expensive to repair. This is especially important for a freehold property in comparison to a condo or apartment, as you will be responsible for all future costs of the property. The inspection fee is generally around $500, but it could save you thousands if not more in repairs versus having discovered the home’s flaws after you’ve signed the contract.

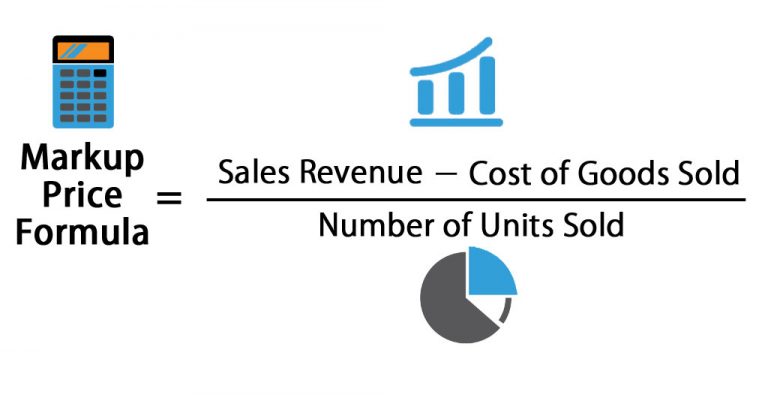

Our calculator uses the estimated home selling price, and various costs such as the real estate agent commission, closing expenses, remaining mortgage balance, and seller discounts. Seller closing costs are a combination of taxes, fees, prepayments and services that vary depending on your location. Closing costs can differ due to variations in local tax laws, lender costs, and title and settlement company fees.

This is not an offer to buy or sell any security or interest. Working with an adviser may come with potential downsides such as payment of fees . There are no guarantees that working with an adviser will yield positive returns.

Be sure to get a WDO report (wood-destroying organism), as the VA requires an inspection of wood-destroying pests. To maximize your home sale, price your home at the right range. If you think overpricing will get you a good deal, it’s actually counterproductive. Sellers who stage their house with a more neutral ambiance helps increase the chances of offers. Once a buyer checks your home, get your furry friends out for a while. If you can hire a pet-sitter, then it’s worth the extra bucks.

Comments

Post a Comment